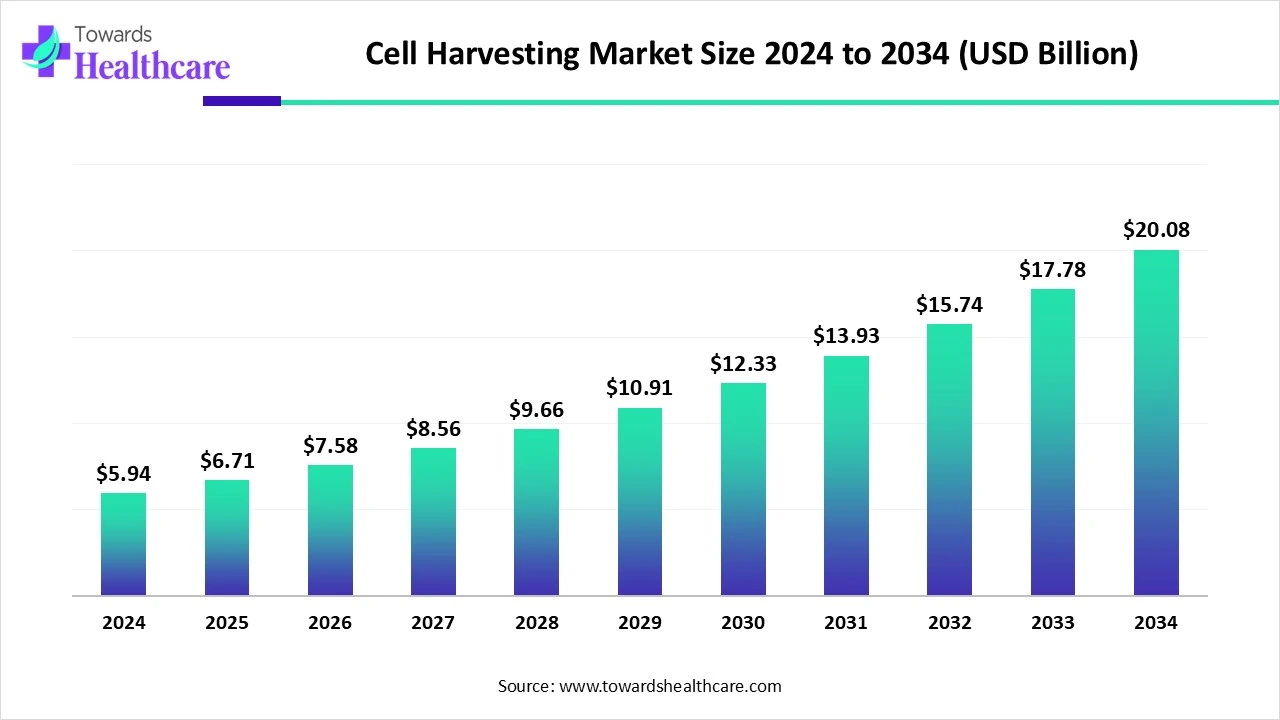

Cell Harvesting Market to Reach USD 20.08 Billion, Growing at a Strong 12.95% CAGR by 2034

The cell harvesting market size recorded US$ 6.71 billion in 2025, set to grow to US$ 7.58 billion in 2026 and projected to hit nearly US$ 20.08 billion by 2034, with a CAGR of 12.95% throughout the forecast timeline.

Ottawa, Nov. 17, 2025 (GLOBE NEWSWIRE) -- The global cell harvesting market size was valued at USD 5.94 billion in 2024 and is predicted to hit around USD 20.08 billion by 2034, rising at a 12.95% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5840

Key Takeaways

- Cell harvesting market to cross USD 5.94 billion in 2024

- Market projected at USD 20.08 billion by 2034

- CAGR of 12.95% expected between 2025 to 2034.

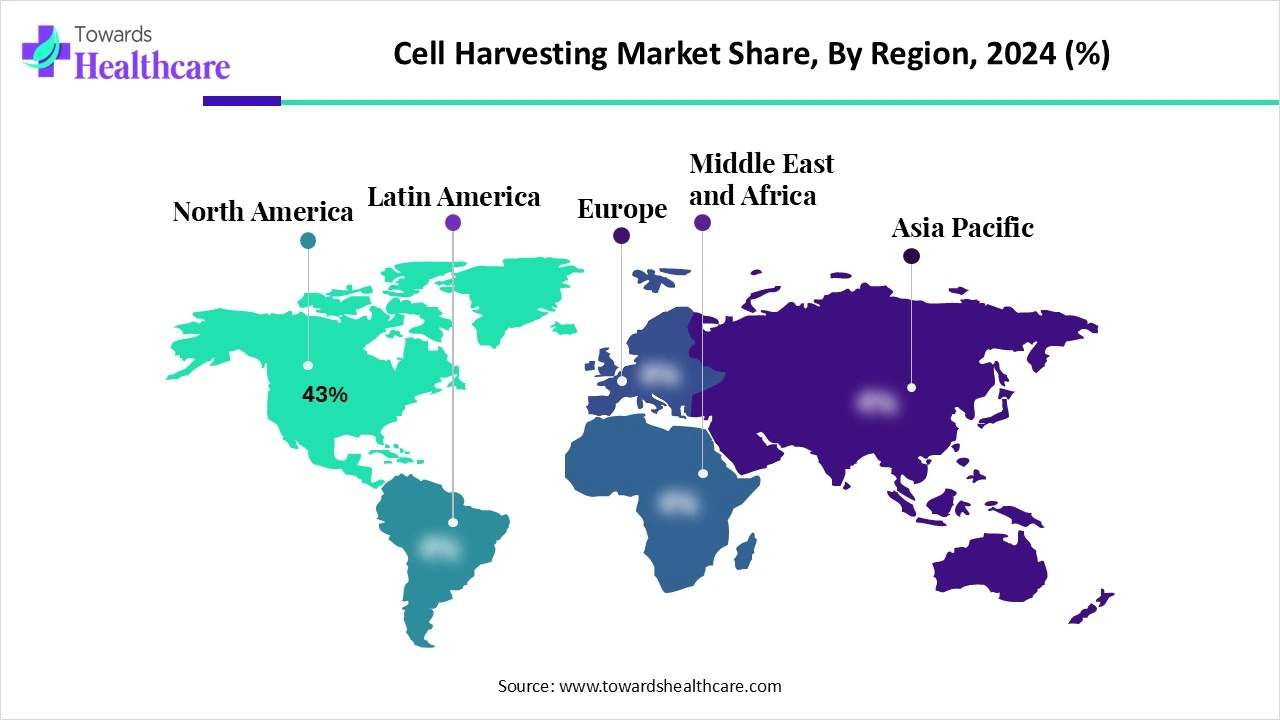

- North America dominated the global cell harvesting market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the upcoming years.

- By product type, the devices & instruments segment led the market in 2024.

- By product type, the consumables segment is expected to witness rapid expansion during 2025-2034.

- By cell type, the mammalian cells segment registered dominance in the market in 2024.

- By cell type, the stem cells segment is expected to be the fastest-growing in the predicted timeframe.

- By application type, the biopharmaceutical production segment captured a major share of the market in 2024.

- By application type, the cell & gene therapy manufacturing segment is expected to grow rapidly during 2025-2034.

- By technique type, the centrifugation-based harvesting segment was dominant in the market in 2024.

- By technique type, the automated & closed system harvesting segment is expected to grow at a rapid CAGR in the coming years.

- By end user, the biopharmaceutical & biotechnology companies segment accounted for the largest share of the global cell harvesting market in 2024.

- By end user, the cell therapy companies & CDMOs segment is expected to register the fastest growth in the studied years.

What is Cell Harvesting?

The cell harvesting market encompasses the process of separation of target cells from a growth medium after cell culture. A rise in demand for regenerative medicine and cell-based therapies is acting as a major catalyst in the overall market expansion. Currently, the market is focusing on the combination of single-use systems with automated depth filtration and tangential flow filtration (TFF), real-time data monitoring, and the emergence of microfluidic systems for high-throughput settings.

Key Metrics and Overview

| Metric | Details | |

| Market Size in 2025 | USD 6.71 Billion | |

| Projected Market Size in 2034 | USD 20.08 Billion | |

| CAGR (2025 - 2034) | 12.95 | % |

| Leading Region | North America share by 43% | |

| Market Segmentation | By Product Type, By Cell Type, By Application, By Technique, By Region | |

| Top Key Players | Thermo Fisher Scientific Inc., Merck KGaA (MilliporeSigma), GE HealthCare (Cytiva), Sartorius AG, Eppendorf SE, BD Biosciences, Terumo BCT, Inc., Beckman Coulter Life Sciences (Danaher), Miltenyi Biotec GmbH, Fresenius Kabi (CompoFlex & LOVO systems), Corning Incorporated, Lonza Group AG, Repligen Corporation, Asahi Kasei Medical Co., Ltd., Stemcell Technologies Inc., PerkinElmer Inc. (Revvity), Bio-Rad Laboratories, Inc., PBS Biotech, Inc., Terumo Corporation, Applikon Biotechnology (a Getinge company) | |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Significant Drivers in the Cell Harvesting Market?

A rise in the incidence of chronic diseases, especially cancer, cardiovascular diseases, and autoimmune disorders, and the growing stem cell research & banking are fueling the global market development. Furthermore, the increasing investments from both public and private sectors are supporting R&D in stem cell therapies and other cell-based solutions used as the treatment for diverse diseases. Ongoing technological advances, such as CRISPR-Cas9, are allowing more accurate and effective modification of cells, making cell-based therapies safer.

What are the Prominent Trends in the Cell Harvesting Market?

- In September 2025, Pluristyx Inc. and BioLamina AB partnered to streamline, derisk, and escalate clinical translation of iPSC-based therapies.

- In June 2025, Celltrio secured $15 million in financial investment to elevate global growth in cell culturing and cell & gene therapy automation.

- In May 2025, the Maryland Stem Cell Research Commission awarded over $18 million in grants focused on escalating cutting-edge stem cell and regenerative medicine research across Maryland.

What is the Crucial Challenge in the Cell Harvesting Market?

The growing need for higher expenses for sophisticated technologies, as well as stricter and time-consuming regulatory approvals, the requirement for non-standardized protocols, and ethical issues, mainly stem cell research, are creating a major hurdle in the market expansion.

Regional Analysis

How did North America Dominate the Market in 2024?

In 2024, North America captured a major revenue share of 43% market. The presence of well-developed biotechnology and pharmaceutical sectors, vital investments in regenerative medicine, and cell-based research are driving the regional market growth. Supportive regulatory solutions, including the FDA's fast-track program for cell and gene therapies, are also fostering the development and boosting investment.

For instance,

- In October 2025, Relive Health and Dr. Adeel Khan partnered to leverage innovative muse cell therapy in the United States for the first time.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

What Made the Asia Pacific Grow Significantly in the Market in 2024?

In the future, the Asia Pacific is anticipated to register the fastest growth in the cell harvesting market. A prominent catalyst is a robust government for research and development, specifically in China, Japan, and India, integrated with accelerated healthcare spending, which is boosting the adoption of advanced technologies. Whereas Chinese researchers are increasingly transforming modular 3D-printed microfluidic systems for continuous, large-scale harvesting of mesenchymal stem cells (MSCs) from microcarriers.

For instance,

- In October 2024, Sino-Biocan introduced the self-developed WUKONG Automated, Closed, Integrated Cell Processing System, building on its existing modular cell preparation platforms.

Cell Harvesting Market: Recent Efforts in 2025

| National Institutes of Health (NIH) | Coordinated with the Food and Drug Administration (FDA) and implemented a new funding opportunity in 2025 for clinical trials using adult stem cells. |

| National Cancer Institute (NCI) | Continued to fund projects in 2025 that establish biomimetic, tissue-engineered technologies for cancer research. |

| Indian Council of Medical Research (ICMR) | Joined with the Department of Biotechnology (DBT) to develop new guidelines in May 2025 for the ethical and safe use of stem cells. |

| European Medicines Agency (EMA) | Recommended conditional market authorization for Zemcelpro, a stem cell therapy for adults with certain blood cancers |

Segmental Insights

By product type analysis

Which Product Type Led the Cell Harvesting Market in 2024?

The devices & instruments segment accounted for the largest share of the market in 2024. This mainly comprises automated systems, centrifuges, incubators, and cryostorage equipment. Currently, the market is bolstering integration of robotic systems, such as the CellXpress.ai Automated Cell Culture System and the AUTOSTEM platform combines liquid handlers, incubators, imagers, and robotics to handle the comprehensive cell culture workflow. Also, they are imposing the evolution of enclosed, single-use systems for preventing contamination.

On the other hand, the consumables segment is estimated to expand at a rapid CAGR. This primarily uses diverse reagents, media, cryopreservation agents, and single-use processing equipment. Ongoing efforts are supporting a shift from serum-containing media to serum-free, xeno-free, and chemically defined media. Alongside, the market is stepping into single-use, disposable consumables, the wider adoption of GMP-grade consumables, and the use of cryovials and cryobags developed for low-temperature freezing.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By cell type analysis

What Made the Mammalian Cells Segment Dominant in the Market in 2024?

The mammalian cells segment held the biggest share of the cell harvesting market in 2024. The widespread need for therapeutic proteins, biosimilars, and vaccines, in which these cells act as a critical driver in producing complex molecules. The leading players are increasingly using the acoustic wave separation method, with low-frequency acoustic which foster the development of standing waves that trap cells, finally supporting aggregation and settling out of suspension.

However, the stem cells segment will expand rapidly during 2025-2034. An expanding demand for personalized medicine, broader investment in the field, and a growth in clinical trials and public awareness of stem cell therapies are propelling the overall adoption. These cell harvests consist of less invasive sourcing of iPSCs from reprogrammed adult cells, and a novel plan to increase hematopoietic stem cell (HSC) yields by recognizing and manipulating macrophage-like markers on stem cells.

By application type analysis

Which Application Type Led the Cell Harvesting Market in 2024?

The biopharmaceutical production segment registered dominance with a dominant share of the market in 2024. A rise in applications of cell harvesting in immunotherapy, eventually for cancer treatments like CAR-T cell therapy, needs specialized harvesting technologies. Ongoing greater adoption of single-use components, especially bioreactors, connectors, and filter capsules, is enabling the lowering of the risk of cross-contamination and reducing the time and expenditure linked with cleaning and sterilization.

In the future, the cell & gene therapy manufacturing segment is predicted to witness rapid expansion. The rising cases of cancer, autoimmune disorders, and genetic diseases are fueling the wider demand for these therapies. These companies are widely exploring fully automated platforms with integration of the harvest step into the overall process, lowering manual intervention and optimizing consistency. These manufacturing approaches employ automated microfluidic platforms, which facilitate high-precision cell separation based on size and deformability, mainly for small-scale and high-throughput applications.

By technique type analysis

Why did the Centrifugation-Based Harvesting Segment Dominate the Market in 2024?

In the cell harvesting market, the centrifugation-based harvesting segment held a major share in 2024. The segment is fueled by the increasing advances in single-use centrifuge systems are which have promising advantages, such as consistency, scalability, and minimized waste as compared to traditional systems. Although the major players are implementing their breakthroughs in counterflow centrifugation for gentler cell separation with enhanced viability, diverse automated devices, and other centrifugal microfluidics.

On the other hand, the automated & closed system harvesting segment is anticipated to expand fastest. The escalating need for enhanced reproducibility and yield, minimal contamination risk and labor expenses, scalability for large-scale manufacturing, and advances in automation technologies like AI and machine learning are propelling the segmental growth. The latest development includes Miltenyi Biotec's CliniMACS Prodigy and Lonza's Cocoon to achieve cell isolation, activation, expansion, and formulation within a single, completely closed system.

By end user analysis

How did the Biopharmaceutical & Biotechnology Companies Segment Dominate the Market in 2024?

The biopharmaceutical & biotechnology companies segment registered dominance in the global cell harvesting market in 2024. The segment is driven by a rise in demand for cell-based therapies, the requirement for automated and high-throughput systems in late-stage drug trials, and commercial manufacturing. They are highly using integrated AI and machine learning for process improvements, the development of next-generation technologies, including fiber chromatography, and the wider adoption of single-use systems.

Whereas, the cell therapy companies & CDMOs segment is estimated to expand at a rapid CAGR in the coming era. Primarily, CDMOs are offering integrated solutions to handle the comprehensive workflow from cell modification to final product formulation. They are putting efforts into advanced digital solutions that are further employed for real-time data sharing among manufacturing teams and clients. Moreover, they are providing expertise, sophisticated technology, and manufacturing capacity in managing both development and large-scale production.

Browse More Insights of Towards Healthcare:

The global cell culture microcarriers market size is calculated at USD 3.18 billion in 2024, grew to USD 3.45 billion in 2025, and is projected to reach around USD 7.2 billion by 2034. The market is expanding at a CAGR of 8.54% between 2025 and 2034.

The global cell migration and cell invasion assay market size is calculated at USD 1.84 in 2024, grew to USD 2 billion in 2025, and is projected to reach around USD 4.1 billion by 2034. The market is expanding at a CAGR of 8.34% between 2025 and 2034.

The global cell culture vessels market size was evaluated at US$ 4.28 billion in 2024 and is expected to attain around US$ 17.59 billion by 2034, growing at a CAGR of 15.18% from 2024 to 2034.

The global cell culture collagen market size is estimated at US$ 2.31 billion in 2024 and is projected to grow to US$ 2.45 billion in 2025, reaching around US$ 4.19 billion by 2034. The market is projected to expand at a CAGR of 6.15% between 2025 and 2034.

The global cell & gene therapy logistics market size is estimated at US$ 1.45 billion in 2024, is projected to grow to US$ 1.62 billion in 2025, and is expected to reach around US$ 4.33 billion by 2034. The market is projected to expand at a CAGR of 11.54% between 2025 and 2034.

The global cell and gene therapy CRO market size is estimated at US$ 4.90 billion in 2024, is projected to grow to US$ 5.39 billion in 2025, and is expected to reach around US$ 12.59 billion by 2034. The market is projected to expand at a CAGR of 9.9% between 2025 and 2034.

The global cell and gene overexpression service market size is calculated at US$ 771.40 million in 2024, grew to US$ 805.73 million in 2025, and is projected to reach around US$ 1,192.24 million by 2034. The market is expanding at a CAGR of 4.45% between 2025 and 2034.

The global cell and gene therapy thawing equipment market size recorded US$ 0.96 billion in 2024, set to grow to US$ 1.1 billion in 2025 and projected to hit nearly US$ 3.56 billion by 2034, with a CAGR of 14.24% throughout the forecast timeline.

The global cell therapy raw materials market size is calculated at US$ 5.43 in 2024, grew to US$ 6.75 billion in 2025, and is projected to reach around US$ 48.54 billion by 2034. The market is expanding at a CAGR of 24.5% between 2025 and 2034.

The global cell separation technologies market size is calculated at USD 15.84 billion in 2024, grew to USD 18.32 billion in 2025, and is projected to reach around USD 67.75 billion by 2034. The market is expanding at a CAGR of 15.64% between 2024 and 2034.

What are the Recent Developments in the Cell Harvesting Market?

- In October 2025, Allied Pain & Spine Institute (APSI), a leading provider of comprehensive musculoskeletal and interventional care, launched OrthoGen Health, an innovative regenerative medicine division.

- In October 2025, PromoCell, a leading global manufacturer of primary human cells and specialized cells, unveiled custom GMP cell culture media to empower next-gen cell and gene therapies.

- In August 2025, the IAEA unveiled a new stem cell research project to optimize healing for patients suffering from severe radiation skin injuries.

Cell Harvesting Market Key Players List

- Thermo Fisher Scientific Inc.

- Merck KGaA (MilliporeSigma)

- GE HealthCare (Cytiva)

- Sartorius AG

- Eppendorf SE

- BD Biosciences

- Terumo BCT, Inc.

- Beckman Coulter Life Sciences (Danaher)

- Miltenyi Biotec GmbH

- Fresenius Kabi (CompoFlex & LOVO systems)

- Corning Incorporated

- Lonza Group AG

- Repligen Corporation

- Asahi Kasei Medical Co., Ltd.

- Stemcell Technologies Inc.

- PerkinElmer Inc. (Revvity)

- Bio-Rad Laboratories, Inc.

- PBS Biotech, Inc.

- Terumo Corporation

- Applikon Biotechnology (a Getinge company)

Segments Covered in the Report

By Product Type

- Devices & Instruments

- Centrifuges

- Automated cell harvesters

- Cell separators

- Filters & membrane-based systems

- Consumables

- Harvesting kits

- Tubing & disposables

- Reagents & enzymes

By Cell Type

- Stem Cells

- Mesenchymal stem cells

- Hematopoietic stem cells

- Induced pluripotent stem cells (iPSCs)

- Mammalian Cells

- CHO cells, HEK293, Vero cells (for biologics & vaccine production)

- Immune Cells

- T-cells, NK cells, B-cells (for immunotherapies)

- Microbial & Plant Cells

- Algae, yeast, bacteria (used in nutraceuticals & industrial biotech)

By Application

- Biopharmaceutical Production

- Monoclonal antibodies

- Recombinant proteins

- Cell & Gene Therapy Manufacturing

- Cancer & Immunology Research

- Stem Cell Research & Regenerative Medicine

- Vaccine Production

- Tissue Engineering

By Technique

- Centrifugation-Based Harvesting

- Filtration-Based Harvesting

- Automated & Closed System Harvesting

- Microfluidics & Membrane-Based Separation

- Magnetic Separation (for immune cells & precision harvesting)

By End User

- Biopharmaceutical & Biotechnology Companies

- Cell Therapy Companies & CDMOs

- Academic & Research Institutions

- Contract Research Organizations (CROs)

- Hospitals & Transplant Centers

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5840

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.