Cooking Wine Market Size to Exceed USD 723.23 Million by 2035 | Towards FnB

According to Towards FnB, the global cooking wine market size is evaluated at USD 474.27 million in 2026 with an expected growth trajectory that will take it to approximately USD 723.23 million by 2035. This growth is anticipated at a compound annual growth rate (CAGR) of 4.8% during the period from 2026 to 2035, highlighting the increasing adoption of cooking wine in culinary applications worldwide.

Ottawa, Jan. 23, 2026 (GLOBE NEWSWIRE) -- The global cooking wine market size stood at USD 452.55 million in 2025 and is predicted to grow from USD 474.27 million in 2026 to reach around USD 723.23 million by 2035, as reported by Towards FnB, a sister firm of Precedence Research. This growth reflects both increased consumer adoption and expanding market penetration across regions.

The market is observed to grow due to rising awareness regarding the flavor-enhancing properties of wine when used while cooking. Higher demand for international cuisines and global flavors also helps to fuel the growth of the market. Rising consumer interest in gourmet cuisine is another major factor for the growth of the market.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5985

Key Highlights of the Cooking Wine Market

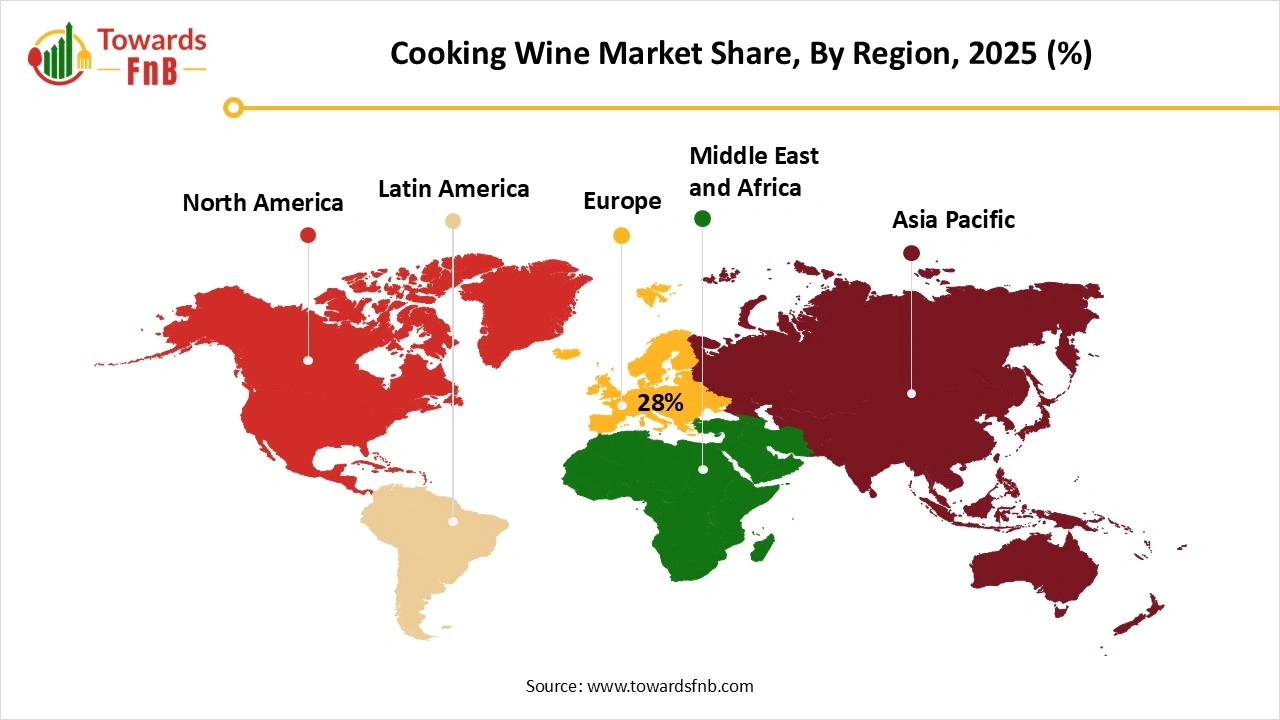

- By region, Europe led the cooking wine market with largest share of 28% in 2025.

- By region, the Asia Pacific is expected to grow in the foreseeable period.

- By product, the dessert wine segment led the cooking wine market in 2025.

- By product, the red wine segment is observed to grow in the foreseen period.

- By application, the B2B segment led the cooking wine market in 2025.

- By application, the B2C segment is observed to grow in the foreseen period.

Growing Demand for Gourmet Cuisine and Home Cooking Propelling the Growth of the Cooking Wine Market

The cooking wine market is observed to grow due to higher demand for gourmet cuisine, home cooking, and international flavors. The cooking wine is made by adding salt and preservatives to maintain the shelf life of the product, further fueling the growth of the market. The market is also observed to grow due to higher demand for global and international cuisines, food trends, and convenience, flavor enhancement, tenderizing, and deglazing meats also help to fuel the growth of the market.

Easy availability of different types of cooking wines online and on various other platforms also helps to fuel the growth of the market. Increased usage of cooking wines in the food and beverages industry for home cooking and industrial levels also helps to fuel the growth of the market.

Technological Advancements Are Helpful for the Growth of the Cooking Wine Market

Technological advancements in the form of AI, IoT, AR, and blockchain are highly helpful for the growth of the market, along with enhancing the product quality. The technology, in the form of multiple applications, employs AI to provide personalized wine suggestions depending on user preferences by scanning wine labels or lists. The procedure helps individual consumers with essential details such as offers, reviews, and average prices of the products to make the wine selection process a tailored one for the consumers. The biotechnology and non-thermal techniques provide solutions for modulating the sensory profiles and stability of new wines, further fueling the growth of the market.

Impact of AI in the Cooking Wine Market

Artificial intelligence is increasingly being applied in the cooking wine market to enhance formulation consistency, alcohol control, and quality standardization across culinary, foodservice, and packaged food applications. Machine learning models analyze fermentation inputs, alcohol-by-volume targets, salt levels, acidity, and volatile compound profiles to design cooking wine formulations that deliver stable flavor performance during high-heat processing while complying with culinary and regulatory requirements. In product development, AI supports flavor optimization by predicting how cooking wines interact with proteins, fats, and sugars during thermal processing, helping manufacturers tailor profiles for marinades, sauces, and ready-meal systems without excessive trial batches.

During production, AI-enabled process control systems monitor fermentation kinetics, alcohol adjustment, and thermal treatment to reduce batch variability and ensure consistent sensory outcomes at scale. AI is also used in shelf-life and stability modeling to anticipate oxidation risk, flavor degradation, and sediment formation under different storage and distribution conditions. From a regulatory and compliance perspective, AI assists in alcohol classification, labeling validation, and formulation screening by aligning product specifications with food safety and alcohol-use guidance referenced by the Food and Agriculture Organization and regulatory oversight frameworks enforced by the U.S. Food and Drug Administration.

Recent Development in the Cooking Wine Market

- In December 2025, The Leela Palace New Delhi announced the launch of Turya, their exclusive private-label wine. The exclusive product is created in partnership with Grover Zampa Vineyards, a huge moment for India’s luxury wine narrative.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/cooking-wine-market

New Trends in the Cooking Wine Market

- Higher demand for alcohol-free, low-sodium, and healthier alternatives to enhance the flavor of different preparations helps to fuel the growth of the market.

- Higher demand for innovative products of the industry in the form of wine sprays, pre-mixed sauces, and tailored blends for different types of cuisines also helps to fuel the growth of the market.

- Higher demand for high-quality cooking wines for the preparation of global, traditional, and flavorful recipes also helps to fuel the growth of the market.

- Adoption of eco-friendly manufacturing and packaging options also helps to propel the market’s growth.

- Availability of the product on online retail channels and D2C models also helps to fuel the market’s growth.

Product Survey of the Cooking Wine Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or User Segments | Representative Brands or Product Types |

| Rice Cooking Wine | Fermented rice-based wine used to enhance aroma and remove raw odors during cooking | Shaoxing-style, clear rice wine | Asian cuisine manufacturers, foodservice kitchens | Traditional rice cooking wines |

| Wine-Based Cooking Wine | Grape wine formulated specifically for culinary use with controlled acidity and salt | Red, white, fortified variants | Sauce manufacturers, ready-meal producers | Culinary red and white cooking wines |

| Fortified Cooking Wine | Wine blended with added alcohol and salt for shelf stability | Sherry-style, marsala-style | Professional kitchens, institutional catering | Fortified cooking wine products |

| Salted Cooking Wine | Cooking wine containing added salt to distinguish from beverage alcohol | Salted rice wine, salted grape wine | Retail cooking, foodservice | Salted culinary wine formulations |

| Low-Alcohol Cooking Wine | Reduced-alcohol formulations designed for flavor without high ethanol | Low-ABV variants | Health-focused and institutional kitchens | Low-alcohol cooking wines |

| Alcohol-Free Cooking Wine | De-alcoholized wine used purely for flavor contribution | Alcohol-free red and white variants | Alcohol-restricted foodservice, packaged foods | Non-alcoholic cooking wine |

| Specialty Ethnic Cooking Wines | Region-specific culinary wines used in traditional cuisines | Mirin-style, Chinese yellow wine | Ethnic food manufacturers, specialty restaurants | Regional cooking wine styles |

| Industrial Cooking Wine | Bulk-format cooking wine designed for large-scale food production | Drum and IBC formats | Processed food and sauce manufacturers | Industrial culinary wine supplies |

| Flavored Cooking Wine | Cooking wine infused with herbs or spices for specific recipes | Herb-infused variants | Ready-to-cook meal producers | Flavored culinary wine products |

| Private Label Cooking Wine | Contract-manufactured cooking wine for retailers and distributors | Store-brand formulations | Retail chains, foodservice distributors | Private-label cooking wine lines |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5985

Cooking Wine Market Dynamics

What Are the Growth Drivers of the Cooking Wine Market?

Growing interest in home cooking and preparing various restaurant-style meals at home is one of the major factors for the growth of the cooking wine market. Higher demand for Mediterranean, Asian, and French cuisine, with the use of cooking wine as a staple ingredient, also helps to fuel the growth of the market. Globalization and the rise of international culinary cuisines by consumers of different age groups are another major factor for the growth of the market. Preparation of various types of sauces, marinades, and meal kits involving the use of cooking wine in them is another major factor for the growth of the market. Cooking wines help to enhance the flavor profiles of various preparations and cuisines by deglazing and tenderizing meat, and adding depth to the flavor is another major factor for the growth of the market.

Lower Consumer Awareness Is Hampering the Growth of the Market

Lower knowledge of cooking wines to enhance the taste of various culinary cuisines in developing and underdeveloped regions is one of the major restrictions in the growth of the market. Regions with strict cultural norms or rules promoting no alcohol consumption also restrain the growth of the market. Availability of replacements such as vinegar and lemon juice also hampers the growth of the market. Hence, such factors altogether hamper the growth of the market.

Rising Home Cooking Trends Is Another Major Factor Propelling the Growth of the Cooking Wine Market

The growing culture of preparing various culinary dishes at home involving the use of cooking wine is one of the major factors for the growth of the market. The market is also observed to grow due to the rising trend of following online cooking tutorials at home, and preparing international and global cuisines at home is another major factor fueling the growth of the market. Requirement of diverse culinary wines to propel the tastes of international cuisines and add an authentic touch to them is another major factor propelling the growth of the market.

Cooking Wine Market Regional Analysis

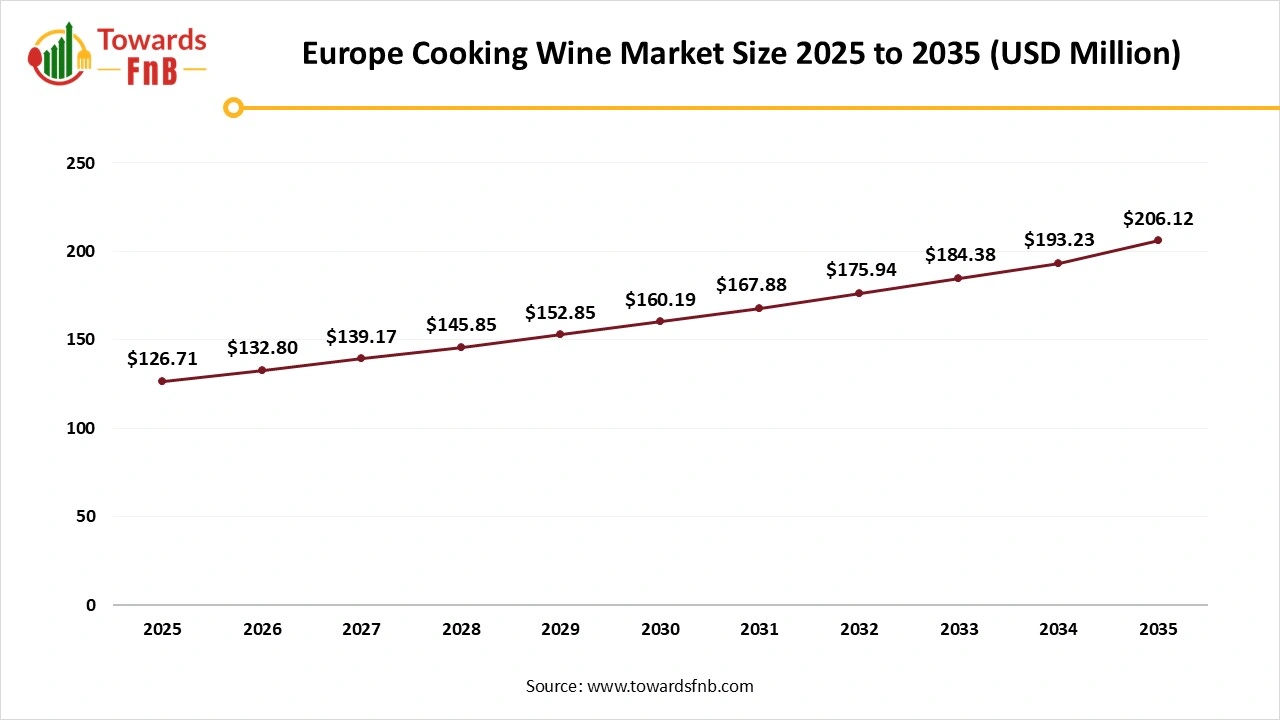

Europe Dominated the Cooking Wine Market in 2025

Europe dominated the cooking wine market in 2025, due to the growing culture of home cooking and premiumization in the region. Higher demand for premium and authentic ingredients for the preparation of global and international cuisines also helps to enhance the market’s growth. Expanding the food service sector with strategic market expansions also helps to fuel the market’s growth in the foreseeable period. Germany has undoubtedly made a massive contribution to the growth of the cooking wine market, being the fourth-largest wine consumer globally.

Asia Pacific Is Observed to Be the Fastest-Growing Region

Asia Pacific is observed to be the fastest-growing region in the foreseen period due to higher demand for authentic, premium, and flavorful cooking wine options, fueling the growth of the market. Higher demand for organic and low-sodium cooking wines by health-conscious consumers is another major factor propelling the growth of the market in the foreseeable period. China has made a major contribution to the growth of the market due to higher demand for cooking wines in different flavor options, the presence of multiple competitors, and advanced kitchen upgrades, which help propel the growth of the market.

North America Is Observed to Have a Notable Growth in the Foreseeable Period

North America is observed to have a notable growth in the foreseen period due to the growing trend of home cooking and higher demand for international gourmet flavors, fueling the growth of the market. Increasing awareness of cooking wines for the preparation of international cuisines at home is another major factor fueling the growth of the market. The US has made a major contribution to the growth of the market due to the growing home cooking trend and higher inclination of consumers towards global and international flavors, requiring the use of different types of cooking wines.

Trade Analysis for the Cooking Wine Market

What Is Actually Traded (Product Forms and HS Proxies)

- Cooking wine products designed specifically for culinary use, including rice wine variants such as Shaoxing and other fermented wine products for food preparation, are typically classified under HS 220600 (wine of fresh grapes, including fortified wines; grape must) with interpretation for culinary use, or under HS 21039090/21039040 (miscellaneous edible preparations including culinary liquid wine products) depending on how customs authorities treat non-beverage culinary wine.

- Rice-based cooking wines and similar fermented grain wines used in marinades and sauces are commonly treated within the broader wine and culinary beverage categories in customs data, often reported collectively with code 2103 or adjacent headings, reflecting varied national tariff practice.

- Flavored cooking wines and fortified culinary wine bases formulated with herbs, spices, or specialty taste profiles are cleared under multi-ingredient food preparation codes when not recognized as pure wine under customs classifications.

- Bulk cooking wine bases or concentrates supplied to food manufacturers for further blending in sauces and ready-to-cook products may be classified under aggregated food preparation codes like HS 2106 when incorporated into composite formulations.

- Packaging components and ancillary products such as bottles, containers, and closures used for cooking wine shipments are traded under separate HS headings (e.g., HS 3923, HS 4819), distinct from the wine content itself.

Top Exporters (Supply Hubs)

- China: Major exporter of cooking wines, especially rice wine variants such as Shaoxing wine that are widely used in Chinese and other Asian cuisines.

- France: Exporter of fortified and specialty wine products adapted for culinary markets, benefitting from well-established wine production infrastructure. (Inferred from global wine export patterns under HS 2206.)

- Italy: Exporter of fortified and flavored wine products used in cooking and food processing. (Trade patterns for HS 2206 wine categories indicate strong exports.)

- United States: Supplier of culinary wine products and branded cooking wine formulations for foodservice and retail channels. (Based on national wine ingredient trade flows.)

Top Importers (Demand Centres)

- United States: Significant importer of Asian cooking wines and specialized culinary wine products for restaurants, food manufacturing, and retail. (Common trade flows for cooking wine proxies show U.S. import activity.)

- European Union: Major importer of a broad range of culinary wine products driven by demand from diverse foodservice and processed food sectors. (EU wine import data under HS 220600 is extensive.)

- Japan: Imports culinary wine and rice wine variants used in local and international kitchens. (Japan’s import and export records for wine products show activity in HS 2206.)

- Southeast Asia: Growing import markets for culinary wine products aligned with expanding foodservice sectors and pan-Asian culinary influences. (Based on regional trade patterns in wine and fermented beverages.)

Typical Trade Flows and Logistics Patterns

- Cooking wine products are typically shipped via containerized sea freight from production hubs in Asia and Europe to global demand centres.

- Bulk shipments of culinary wine bases and concentrates move in sealed containers with secure packaging to preserve product integrity.

- Smaller consignments and speciality bottles are shipped by air freight when expedited delivery is needed for foodservice channels.

- Regional distribution centres handle repackaging, compliance labeling, and quality checks prior to delivery to food manufacturers and retailers.

Trade Drivers and Structural Factors

- Culinary demand growth in global foodservice sectors increases consumption of cooking wine as a key flavouring and marinade ingredient.

- Pan-Asian cuisine popularity drives imports of rice wine and specialty cooking wines into Western markets.

- Retail expansion of ready-to-cook and gourmet product lines supports trade in branded cooking wine products.

- Ingredient standardization by food manufacturers creates repeat import demand from approved supplier lists.

- Cost and quality differentials between production regions influence sourcing decisions for culinary wine ingredients.

Regulatory, Quality, and Market-Access Considerations

- Cooking wine products are subject to food safety regulations, including alcohol content limits and labeling requirements in importing countries.

- Classification under specific HS codes influences tariff treatment and documentation requirements during customs clearance.

- Products must comply with local public health and food additive standards, particularly where alcohol content and fermentation processes are regulated.

Importers often require certifications and declarations covering shelf life, ingredients, and sanitary compliance.

Government Initiatives and Public-Policy Influences

- Agricultural and wine quality standards in exporting countries influence production practices and global competitiveness of culinary wine products.

- Trade facilitation policies and tariff agreements affect the cost and volume of cooking wine imports and exports.

- Food safety modernization and labeling laws in destination markets shape regulatory compliance requirements.

- Cultural heritage food promotion programs in some regions support exports of traditional cooking wine products.

Cooking Wine Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 4.8% |

| Market Size in 2026 | USD 474.27 Million |

| Market Size in 2027 | USD 497.04 Million |

| Market Size in 2030 | USD 572.10 Million |

| Market Size by 2035 | USD 723.23 Million |

| Dominated Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Cooking Wine Market Segmental Analysis

Product Analysis

The desert wine segment led the cooking wine market in 2025, due to a higher inclination of consumers towards innovative and experimental flavor options, leading to higher demand for cooking wines with a hint of sweetness and acidity, fueling the growth of the market. Higher demand for cooking wines with a hint of sweetness and rich and bold flavors to enhance the overall flavor of the recipe is another major factor propelling the growth of the market. Such wines are ideal for the preparation of different types of flavor options, such as ice creams, caramels, sweet sauce, and other similar preparations.

The red wine segment is expected to grow in the foreseen period due to its richness, sweetness, and bold flavor profile, making it ideal for sweet as well as savory dishes. Red wines add depth in the preparation of various cuisines and are highly used in the preparation of various international and authentic recipes. Hence, such factors altogether help to fuel the growth of the market.

Application Analysis

The B2B segment dominated the cooking wine market in 2025, due to higher usage of cooking wines in the foodservice industry on a huge scale, such as restaurants, catering businesses, and other similar industries. Cooking wines help to enhance the flavors, richness, and shelf life of the food provided by such businesses, further fueling the growth of the market. Restaurants and other foodservice places use cooking wines often to maintain the authentic and international taste of their global cuisines, allowing them to enhance the dining experience of their customers as well.

The B2C segment is expected to grow in the foreseen period due to the growing trend of home cooking and trying international and global cuisines with the help of different types of cooking wines. The growing trend of trying international cuisines and global flavors at home with the help of online tutorials also helps to fuel the growth of the market in the foreseeable period. Hence, the segment leads to higher demand for cooking wines for deglazing meat and adding depth to the flavor of meat, further fueling the growth of the market.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size is increasing from USD 15.71 billion in 2026 and is expected to surpass USD 37.04 billion by 2035, with a projected CAGR of 10% during the forecast period from 2026 to 2035.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

- Canned Food Market: The global canned food market size is projected to expand from USD 144.43 billion in 2026 to reach around USD 218.37 billion by 2035, growing at a CAGR of 4.7% during the forecast period from 2026 to 2035.

- Dietary Supplements Market: The global dietary supplements market size is projected to reach USD 507.33 billion by 2035, growing from USD 229.77 billion in 2026, at a CAGR of 9.2% from 2026 to 2035.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 142.20 million in 2026 to reach around USD 369.70 million by 2035, growing at a CAGR of 11.2% throughout the forecast period from 2026 to 2035.

- Plant-based Protein Market: The global plant-based protein market size is forecasted to expand from USD 22.10 billion in 2026 and is expected to reach USD 46.82 billion by 2035, growing at a CAGR of 8.7% during the forecast period from 2026 to 2035.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 473.40 billion in 2026 to reach around USD 721.91 billion by 2035, at a CAGR of 4.8% over the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 285.66 billion by 2035, growing from USD 182.57 billion in 2026, at a CAGR of 5.1% during the forecast period from 2026 to 2035.

- Vegan Food Market: The global vegan food market size is evaluated at USD 24.77 billion in 2026 and is expected to reach USD 61.85 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

Top Players in the Cooking Wine Market: Company Overviews and Strategic Impacts

- Elegre: Elegre produces premium cooking wines, focusing on high-quality fortified and dessert wines for culinary applications. Its strategy targets both B2B and B2C markets, capitalizing on the growing demand for gourmet cooking. The company is expanding its reach through online platforms, catering to the rising trend of home cooking and global flavors.

- Iberica Export: Iberica Export specializes in Spanish cooking wines, offering authentic Mediterranean and Iberian options. Its strategic focus on premium, regional products positions it as a key player in the high-end cooking wine market. The company’s strong regional identity appeals to consumers seeking traditional, authentic flavors.

- Marina Foods, Inc.: Marina Foods provides a variety of cooking wines, particularly rice wines, for ethnic and international cuisines. The company leverages a strong distribution network and online sales to meet the growing demand for authentic global flavors. Its focus on specialty ingredients positions it as a leader in the B2B and B2C cooking wine sectors.

- Stratas Foods: Stratas Foods specializes in bulk cooking wines for the foodservice industry, focusing on affordable, high-quality solutions. The company’s strategic approach to serving large-scale food production and institutional kitchens makes it a dominant supplier in the B2B market. Its consistency and cost-effectiveness drive its success.

- The Kroger Co.: Kroger offers a diverse range of cooking wines through its extensive supermarket network and online platforms. Its strategy focuses on catering to the growing demand for health-conscious, sustainable cooking ingredients, making it a key player in both retail and e-commerce segments. Kroger’s wide reach allows it to tap into the increasing trend of home cooking.

- Mizkan America Inc.: Mizkan America provides cooking wines with a focus on Asian-inspired products, such as rice wines. The company’s strong position in the B2B market is bolstered by its expertise in ethnic cuisines, particularly in North America. Its high-quality, authentic products cater to the growing demand for international flavors.

-

Roland Foods, LLC: Roland Foods distributes a wide variety of premium cooking wines, specializing in fortified and dessert wines. With a diverse product portfolio and strong B2B relationships, the company targets the growing demand for gourmet cooking. Roland’s commitment to quality and innovation positions it as a leader in the premium cooking wine market.

Segments Covered in the Report

By Product

- Dessert Wine

- White Wine

- Red Wine

- Others

By Application

- B2B

- B2C

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5985

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://ww w.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Meal Kits Market: https://www.towardsfnb.com/insights/meal-kits-market

➡️Ethnic Food Market: https://www.towardsfnb.com/insights/ethnic-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.